Updated Oct 4, 2023

Federal Pell Grants are usually the first form of financial aid awarded to undergraduate students with high financial need who attend colleges that participate in the federal student aid program. Starting in the 2024-25 academic year, there will be big changes to how both a student’s financial need and a student’s eligibility for a Pell Grant are determined. Below is an explanation of what to expect regarding Pell Grants.

What are Pell Grants and Who Gets Them?

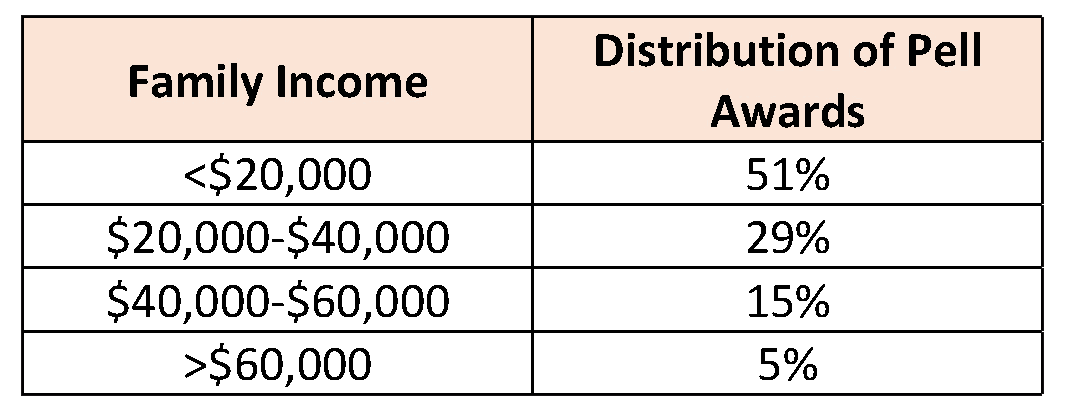

The Pell Grant is a type of federal college financial aid that does not have to be repaid. The 50-year-old Pell Grant program is the largest source of grant aid for college education in the U.S. Approximately 34% of all undergraduate students are eligible for a Pell Grant. Most Pell Grant recipients come from very low-income families as shown here: To be considered for a Pell Grant (and all other federal aid and most college financial aid), you must fill out a FAFSA (Free Application for Federal Student Aid) for each year you attend college.

In the 2022-23 academic year, more than 6 million low- and middle-income undergraduate students received a Pell Grant ranging in size from $692 to $6,895.

To be considered for a Pell Grant (and all other federal aid and most college financial aid), you must fill out a FAFSA (Free Application for Federal Student Aid) for each year you attend college.

In the 2022-23 academic year, more than 6 million low- and middle-income undergraduate students received a Pell Grant ranging in size from $692 to $6,895.

What’s Happening with Pell Grants in 2023-24?

For the 2023-24 academic year, eligibility for and the size of a Pell Grant will be determined by three factors:- The student’s EFC (Expected Family Contribution), which is determined on the FAFSA by an analysis of the family’s combined income and assets

- The student’s enrollment status (full- or part-time)

- The COA of the chosen school

How Will Pell Grant Eligibility Change in 2024-25?

Upon full implementation of the FAFSA Simplification Act in the 2024-25 academic year, eligibility for the Maximum and Minimum Pell Grants will be separated from the student’s FAFSA analysis of family income and assets and will instead be determined in the following ways:- Maximum Pell Grants will automatically be awarded to:

- Dependent students whose parents are non-tax filers

- Independent students who are non-tax filers

- Dependent or independent students under the age of 33 whose parent or guardian died in the line of duty serving as a member of the Armed Forces post-9/11 or died in the line of duty while performing as a public safety officer

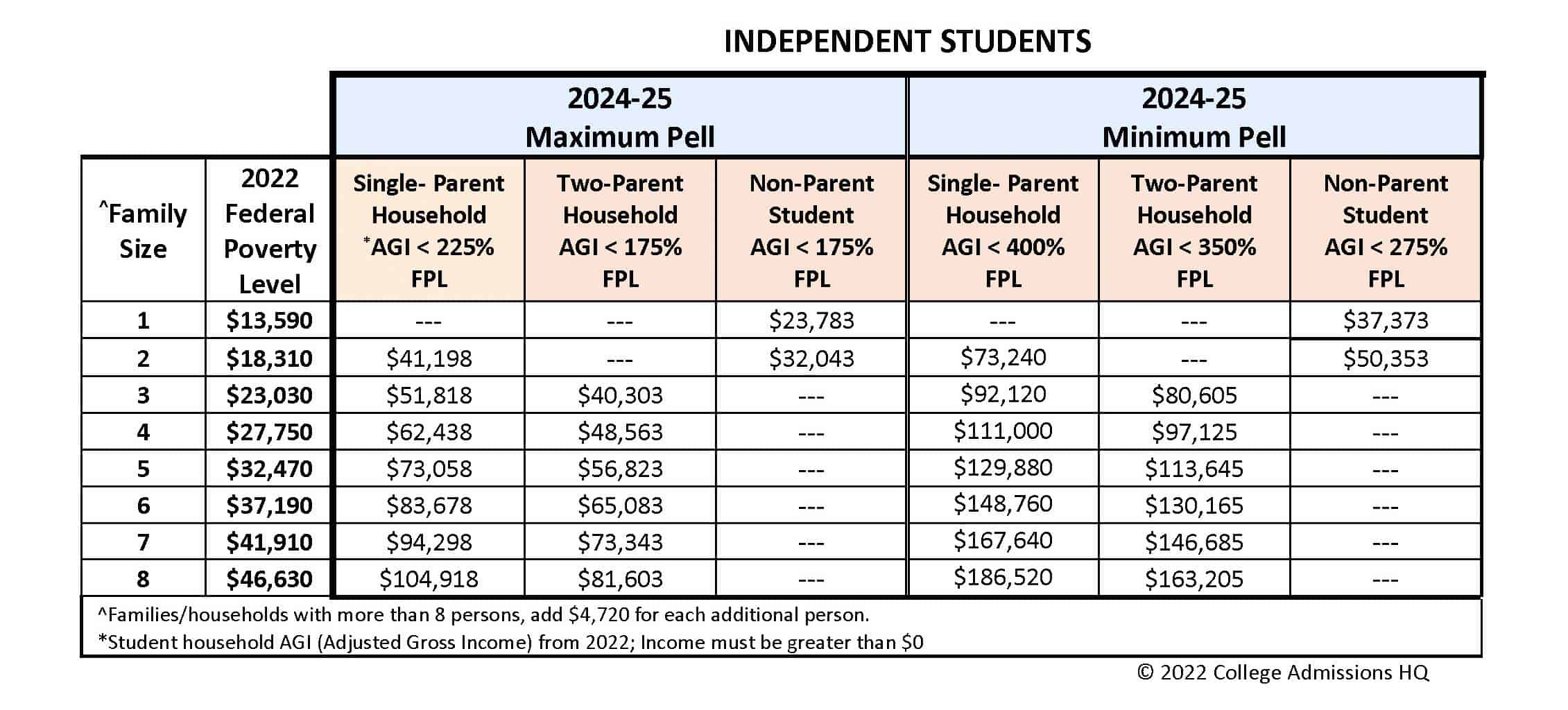

- Other students will qualify for the Maximum or Minimum Pell Grants based on:

- Family size

- Family type (single parent, two-parent, non-parent independent student)

- Prior-prior year adjusted gross income (AGI) as a percentage of the prior-prior year’s Federal Poverty Level (FPL)

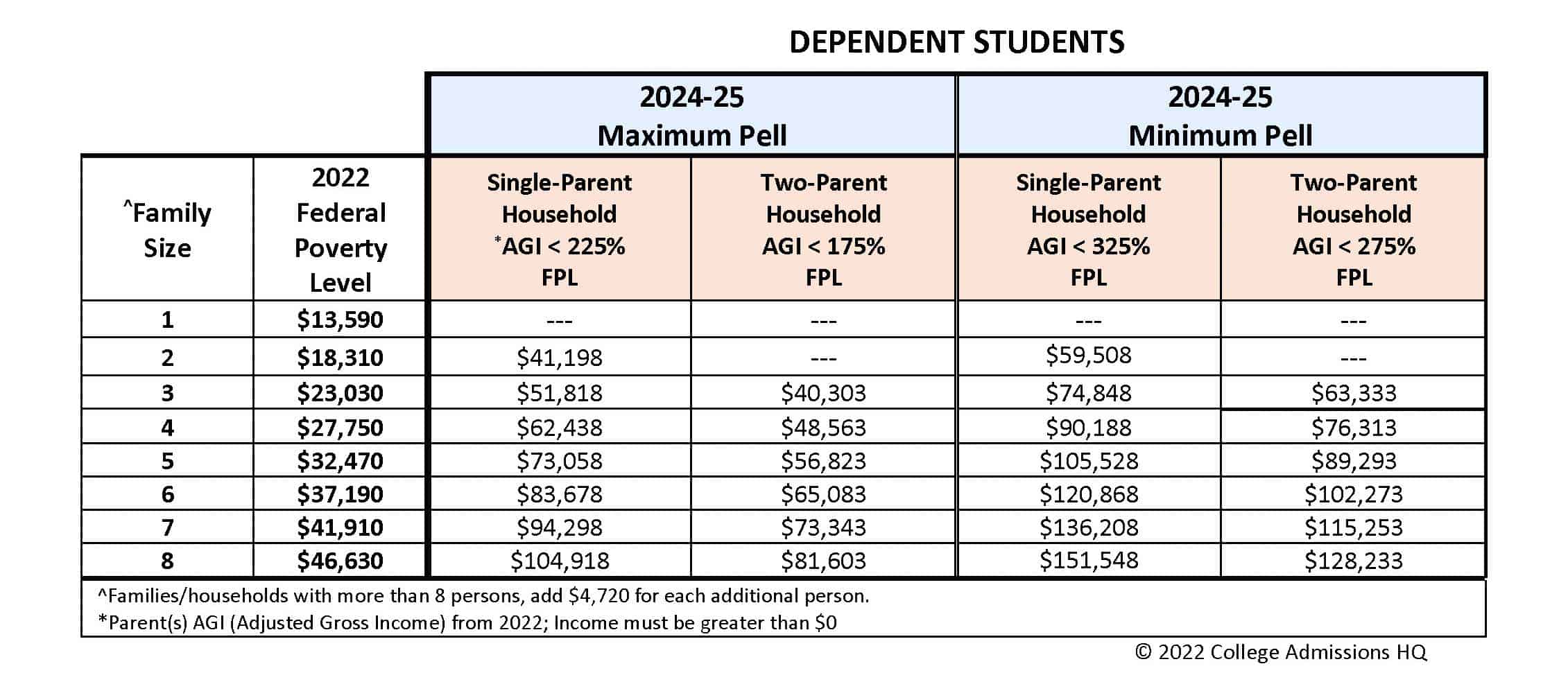

Maximum and Minimum Pell Grant Awards for the 2024-25 Academic Year

Separating the Maximum and Minimum Pell Grants from the FAFSA will allow students, parents, and counselors to know whether the student will qualify for the Maximum or Minimum Pell long before looking at colleges and even before filing their FAFSA (although the FAFSA must be filed to qualify for the Pell).

If a student does not qualify for the Maximum or Minimum Pell based on the tables above, eligibility for a Pell Grant between the Maximum and Minimum will still depend on an evaluation of the student’s family income and assets on the FAFSA. Additionally, in 2024-25, the EFC will be replaced with a new assessment formula called the SAI (Student Aid Index).

Although SAI is largely just a new name for EFC, there will be certain changes in the formula that will impact different families either positively or negatively. Chapter 8 in Pay Less for College/The Must Have Guide to Affording Your Degree, 2023 Edition offers a full explanation of the SAI assessment formula in addition to a guide to all the financial aid changes coming in 2024-25.

Separating the Maximum and Minimum Pell Grants from the FAFSA will allow students, parents, and counselors to know whether the student will qualify for the Maximum or Minimum Pell long before looking at colleges and even before filing their FAFSA (although the FAFSA must be filed to qualify for the Pell).

If a student does not qualify for the Maximum or Minimum Pell based on the tables above, eligibility for a Pell Grant between the Maximum and Minimum will still depend on an evaluation of the student’s family income and assets on the FAFSA. Additionally, in 2024-25, the EFC will be replaced with a new assessment formula called the SAI (Student Aid Index).

Although SAI is largely just a new name for EFC, there will be certain changes in the formula that will impact different families either positively or negatively. Chapter 8 in Pay Less for College/The Must Have Guide to Affording Your Degree, 2023 Edition offers a full explanation of the SAI assessment formula in addition to a guide to all the financial aid changes coming in 2024-25.

Any Other Changes?

Eligibility for Pell Grants will be restored to students who:- Were unable to complete their program of study due to their school closing

- Were falsely certified as eligible to receive federal financial aid

- Had their loans discharged in a successful borrower defense claim

- Are incarcerated and enrolled in a qualifying education program

Learn More!

Paying for college shouldn’t be harder than going to college!